I.

Unless you’ve been living under a rent-controlled rock, you’ve noticed that US housing has become extremely expensive. It’s obvious from your rent, from headlines about the cost of living, from Zillow fantasy shopping that puts an increasing emphasis on the word fantasy.

Still, the actual numbers are quite staggering. The median single family home now sells for over $400K. The Case-Shiller Index, the golden standard for measuring US housing prices, has skyrocketed 133% since 2012 to a new all-time high. (It’s always setting all-time highs.)

Worse, housing devours far more of our paychecks than ever before, and it’s not even close. According to Harvard’s Joint Center for Housing Studies, the median home price to median household income ratio is “higher than at any point on record.” Based on their research and other measures that go further back, a typical US home today costs at least 60% more (relative to median income) than it did at any point from 1965 to 2000. Housing is more expensive (again, relative to income) than it was at the peak of the 2008 housing bubble.

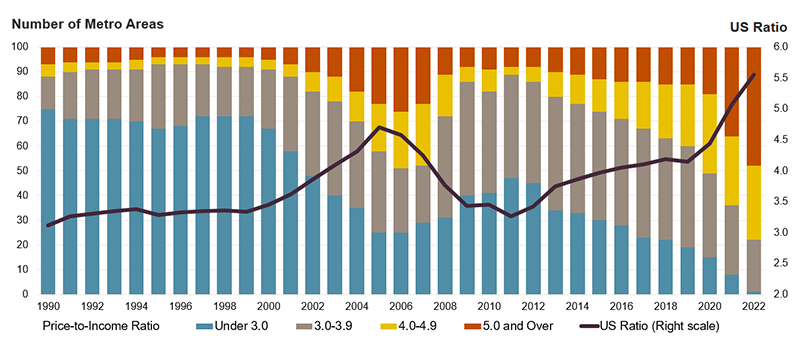

In the US’s 100 largest metros, the picture gets even more dire. In 1990, a typical home in most cities cost less than 3x a typical annual income. Now, it costs more than 5x in most cities. In the worst of the worst — Honolulu, San Jose, and San Francisco — that ratio literally goes up to 11.

How did we get here? Well, from 2012 to today, US housing prices rose more than 7% annually. Those returns would make many profitable, blue-chip companies envious. Chevron, Citigroup, and Coca Cola, for example, are all successful companies who saw their stock price and market cap grow steadily from 2012 to today. And yet, each of those companies’ values rose less than that of a middle-of-the-pack US home.

There’s a specific perspective that views housing’s stock-portfolio-esque growth as a good thing. In an ideal society, people should be gaining wealth over time; homes provide a nice, easy vehicle to ensure it happens. While many people will forget/be intimidated/not have enough money to invest in the stock market, everyone needs to live somewhere. And, once someone buys a house, they are legally required to keep paying the mortgage. In this way, mortgages act as kind of a forced investment account: you have to keep paying, but as long as housing prices rise, you’re golden.

With a decade’s worth of 7% annual returns and most American families living in homes they own, this approach has made a lot of Americans a lot wealthier. They bought a house, watched it double in value, and now have a nice asset they can sell when the kids move out. You want 🚀🚀🚀? Forget crypto and r/wallstreetbets; buy a house. You reap great investment returns for the low, low price of not paying rent.

There are obvious questions, like “is it safe to assume that housing prices will continue to grow at this rate?”

In the past, I’ve found myself debating this question online but, in retrospect, it’s beside the point. I’m not really interested in arguing whether housing prices will keep rising like a stock portfolio.

I’m interested in arguing that, if they do, it would be terrible for society.

If you’re a current homeowner, these gains might look like a nice thing, pure and simple. You made the safe, sound choice by buying a house, and you were rewarded for it. When you go online telling other people that they should buy instead of renting because home values go up, it’s genuine advice based on your real-life experience.

But I worry that in doing so, homeowners are not just predicting an outcome, they’re rooting for it. They want housing prices to keep rising above inflation and income, because it would be financially great for them.

If you find yourself rooting for this, think about the ramifications. You’re rooting for the least affordable housing in history to become even less affordable. You’re looking at the most expensive housing in history and asking: but is this expensive enough?

II.

Say homeowners’ dreams come true and housing prices continue to rise 7% annually for decades to come. What’s the endgame here?

After 10 years, housing prices will nearly double.

After 20 years, they’ll nearly quadruple. Obviously, inflation mitigates the impact, but not much. Assuming 2% annual inflation, homes will be 2.6 times more expensive in inflation-adjusted terms. Or, to put it in more concrete terms, the median house in 20 years will be worth over $1 million in today’s dollars.

It’s almost impossible for wages to keep pace. Even if the US sees solid wages growth because Congress enacted [insert your dream economic policy here], we’ve never seen sustained annual wage growth come near 7%.1 Moreover, if wages somehow did grow that fast, it would drive inflation up (most costs go back to wages) and result in the Fed laying the smackdown hard enough to bring them crashing down.

Let’s stay 20 years in the future.

In this future, the median US housing market has become as expensive as modern-day San Francisco. San Francisco, the poster child of unaffordable housing, the land of $1000-per-square-foot homes, a city you can seriously overhear “I can’t believe this place is only a million dollars!” 20 years of housing value gains will make the typical home in Randomsville, USA as expensive as a home in SF now.

Don’t even think about how expensive San Francisco itself would get! Actually, do think about it. With current median price of $1.2 million, an SF home would be worth over $3 million in today’s dollars. That’s not a mortgage; that’s a ransom.

Sure, this is great for homeowners. They avoided rent, they painted the walls whatever color they wanted, and for their trouble, they netted several hundred thousand dollars (or millions!) in home value.

But imagine a current-day 5-year-old kid, Olivia, in this future.

Or if you know an adorable 5 year old who you love and cherish, imagine them all grown up in 20 years. I’m not above emotional manipulation.

Maybe Olivia went to college, graduated cum laude, got a bunch of prestigious but unpaid internships, held down a good job for a few years, and entered a committed relationship. While she still needs to pay off her student loans, she’s done great for herself and is hoping to buy a nice starter home.

Unfortunately, Olivia’s hypothetical successes are totally irrelevant because the typical house costs an inflation-adjusted $1 million. And that’s just the median, not what it costs in a superstar city where the better, higher-paying jobs are located. Renting has also almost certainly risen alongside housing costs. She’s boxed in. The rent is too damn high, but so are the mortgage payments. She will have to suffer one way or many: commuting 2 hours each way, cramming into a tiny shared apartment, living paycheck to paycheck. At some point, the only fiscally sound choice might be living in her car.

You can’t escape it. If housing prices keep outpacing inflation and wages, eventually, many people — especially young people — simply will not be able to afford them. Having enough money to afford a mortgage payment, or even rent, will become a luxury. The homeowners’ gains are the loss of a new generation who needs somewhere to live.

III.

What frustrates me most about the homes-should-be-a-stock-portfolio mentality: it’s a self-fulfilling prophecy.

As long as we communally believe that housing prices will outpace inflation, that this is a reasonable expectation regardless of how expensive houses are, people will continue to buy houses for $500K, $1 million, $2 million dollars, whatever. People will stretch their budgets and sell their kidneys because they don’t want to miss out on those sweet sweet investment returns.

This ensures that there is always demand for houses, no matter the cost.

Worse, once someone has poured everything they have earned and will earn into a multi-million dollar mortgage, they will absolutely fight to protect its value. They’ll fight against zoning changes and pro-development politicians and three-story apartment complexes that psychologically traumatize the local burrowing owl. And what choice do they have? Any change risks jeopardizes the all-in bet they made on the value of their home. The only rational option is to become a stage-five NIMBY.

And as homes get more expensive, it becomes more essential to get investment grade returns on them. The opportunity cost is huge. If a house costs 10 times an annual salary, rather than 3, it’s gonna hoover up any money that could’ve gone towards other investments. If every dime you earn is going into a house, a flat investment is catastrophic. By encouraging people to expect stock-portfolio returns on a home and requiring them to take larger and larger loans to achieve them, we’re creating a class of people who don’t just hope for investment-grade returns, they need them.

Look, I admit that our expectations aren’t the root cause of any of this.

The root cause of expensive homes is the lack of housing. We didn’t built enough in the places people want to live, so prices rose. Our expectations are just a reaction to that reality. We’re all guessing what will make financial sense in a world where homes are very expensive and somehow always getting more expensive. And it’s not crazy to expect that housing prices will continue to rise as they have the last 25 years.

But I’d at least like us to acknowledge that a society with housing that generates these kinds of returns is fundamentally broken. Yes, it generates wealth for homeowners. But it also creates an underclass who may never have the savings for a down payment nor the income for mortgage payments.

If housing is an investment — not a hedge-on-inflation 2%-return investment, but a real, 5%-or-more-return investment — it must get less affordable, by definition. And as we push the investment logic further to keep the machine churning, we only ensure that more people will never be able to afford a home.

And yet they still must live somewhere. The rising prices will force people into cramped living situations, into two hour-plus commutes, into debt, and eventually, into homelessness. At its core, housing as an investment is in direct conflict with the universal human need for shelter.

That’s why people assuming that housing prices will continue to rise like a stock portfolio worry me so much. Not because I think they’re wrong, but because of what will happen if they’re right.

If you liked this post, check out this related post: Maybe Treating Housing as an Investment Was a Colossal, Society-Shattering Mistake.

Wage growth has averaged ~3% annually, and only exceeded 6% in the 2021/2022 session of pandemic-flation.

I live in a sought-after coastal city in California - retired, homeowner, adult kids who live in town. My house has doubled in market value in ten years, less the full renovation I did. But :

We can't move, because our taxes would double or triple. Prop 13 keeps them stable, if we stay put.

Houses are often sold to out-of-towners for a second or retirement home.

My adult kids can't even imagine paying the mortgage on a house such as ours, if we gave them the down payment.

The local UC has far too little housing, which dumps students into crowded, over-priced rentals.

Gentrification has greatly reduced affordable rentals.

and on and on

True, we could choose to live in a place without good jobs, scenery, culture, medical care... nah.

When I was hiring engineers, I just told candidates from out-of-state to read the Craigslist ads. They never got back to me.

ah well.

What's the end game?

Probably revolution against American Tories to free the wage slaves from the landed gentry class.

Otherwise, we might have to do the hard work of shifting taxes off productive activities and onto ownership of things which were not produced by human effort.